The BLS defines a consumer unit as any of the following: You might be wondering what exactly counts as a consumer unit. Average expenses decreased by 2.7% from 2019 to 2020. The figures presented below are national averages.Ĭonsumer spending in the United States had been steadily increasing, but 2020 was a departure from that trend, likely because of the COVID-19 pandemic. Keep in mind that living cost varies by region - some cities are very affordable, while others are extremely expensive. That means the average spending per year is $61,334. The average expenses per month for one consumer unit in 2020 was $5,111.

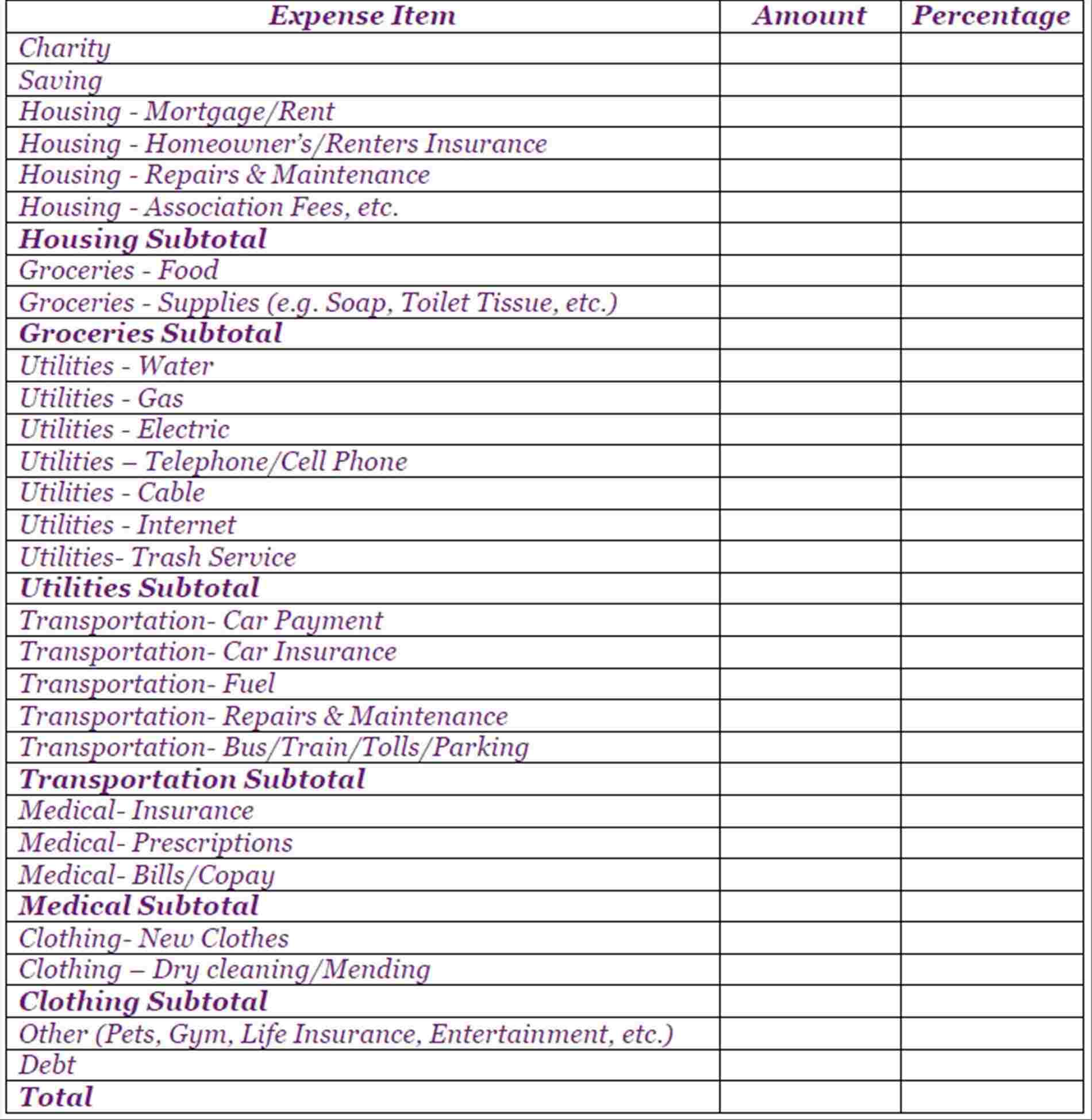

Americans spend $610 on food per month, with about two-thirds being spent on groceries and the rest on eating out.Housing is the largest average cost at $1,784 per month, making up 34.9% of typical spending.The average annual income after taxes is $74,949.The average household's monthly expenses are $5,111 ($61,334 per year).Where does all that money go? For the typical person, it covers quite a few different things from major costs like payments to their mortgage lender and groceries to smaller expenses like apparel.īy peeking into the national average budget for all these categories, we can get a better idea of where people spend the most and how our own spending habits compare. Check out our handy templates to help you prepare different budgeting financial statements.The average monthly expenses for American households are $5,111, according to the most recent Consumer Expenditure Survey from the U.S. With some basic financial knowledge, you can make sure your budget is accurate and up-to-date. But you should always check it carefully for accuracy and ask questions. Your accountant or bookkeeper may help you to prepare your budget. Tip: Be conservative when predicting your income – give yourself some flexibility in case things change. Once your business has been running for a while you can look at past periods to get an idea of what income to expect. You’ll need your expected business income for the budget period.

It may end up saving you money and will become an expense that you know to expect. Tip: If you can, turn your variable costs into fixed costs. If you’re not sure, estimate the maximum amount you expect to spend over the budget period. You’ll need to enter all your variable expenses like: Consider what you would pay someone else to manage your business and pay yourself that amount. Tip: When starting out and deciding on your salary, find a balance. You’ll need to enter all your fixed expenses like your salary, rent, insurance and any other known costs. You might choose monthly, quarterly or yearly budgeting. Time frameĬhoose a time frame for your budget depending on the needs of your business. If you’re starting out in business, there are things you’ll need to include when preparing your budget.

0 kommentar(er)

0 kommentar(er)